June results of an inflation gauge favored by the Federal Reserve mirror those of the better-known Consumer Price Index (CPI) released two weeks earlier, according to a Bureau of Economic Analysis (BEA) report released Thursday.

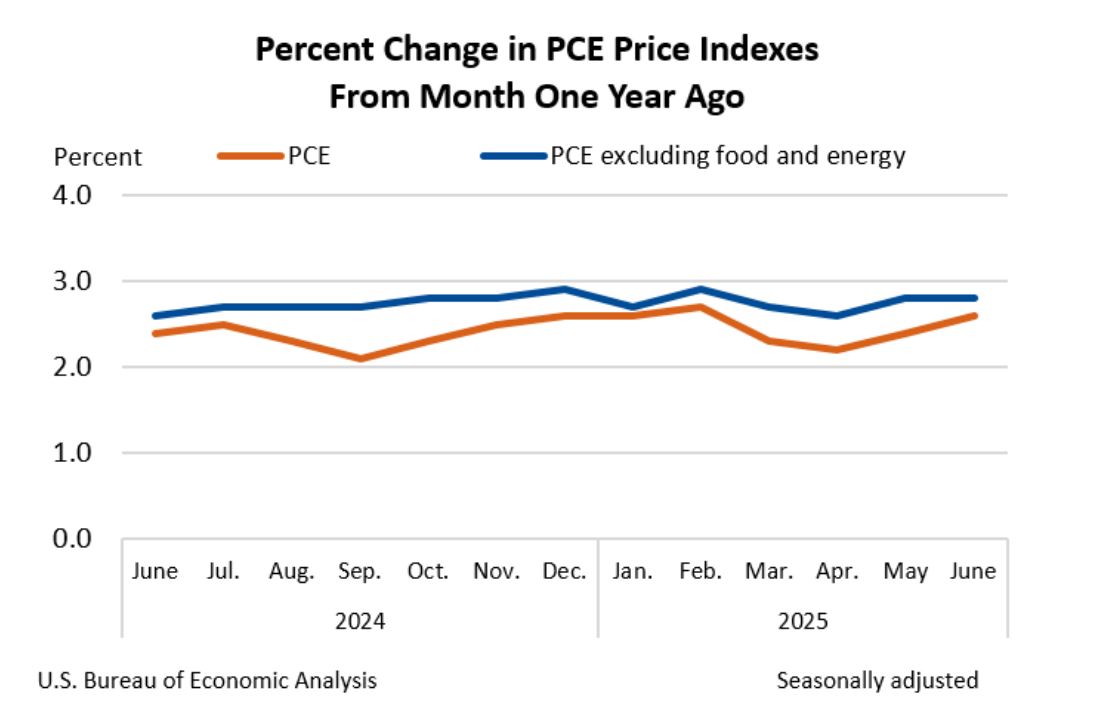

In the BEA’s latest monthly report on U.S. personal income and outlays, the BEA finds that its Personal Consumption Expenditures (PCE) price index for June increased 0.3% from May and 2.6% from the same month in 2024, following May’s increases of 0.2% and 2.4% for the same periods, respectively.

Unlike the CPI, the PCE price index changes the mix of products it uses to measure inflation from month to month, in an effort to account for consumers’ efforts to combat price increases by substituting one product for another.

The so-called “core” PCE index, which excludes the volatile food and energy product categories, rose 0.3% from the previous month and 2.8% from year-ago, compared to May’s increases of 0.2% and 2.8%, respectively.

June’s 12-month PCE price index increase of 2.8% was less than the five-year 3.7% average monthly year-over-year gain.

In June, the PCE price index increases largely mirrored those of the CPI results the BEA reported back on July 15:

On Wednesday, the Federal Reserve announced that it was leaving interest rates unchanged and rejecting President Donald Trump’s urgent and repeated calls for the Fed to lower rates. Thursday’s BEA report appears to further dim prospects of a rate cut, given the Fed’s 2.0% inflation rate goal.

But, the 9-2 vote to keep interest rates at their current levels was the most contentious vote in more than 30 years, as two governors who wanted to lower rates voted against the decision. This marked the first time since 1993 that at least two governors dissented against the majority vote.

This week’s Fed vote was also taken before the BEA released its Gross Domestic Product (GDP) report for June, which revealed a strong rebound in GDP from May’s tariff-fear fueled decline. In June, consumers’ concerns that the Trump Administration’s reciprocal tariffs would increase inflation eased as the U.S. continued to strike trade deals with other countries that had been charging exorbitant rates on American goods.

And, on Tuesday, the Conference Board announced that its Consumer Confidence Index rose in July on the strength of higher expectations for the future, in another sign that consumers are less worried about the administration’s use of tariff threats as a bargaining tool.

At 97.2, July’s preliminary confidence index (through July 20) is up 2.0 points from June’s 95.2 final tally and 4.2 points higher than the June level initially reported by the Board.

“All three components of the Expectation Index improved, with consumers feeling less pessimistic about future business conditions and employment, and more optimistic about future income,” Conference Board Senior Economist Stephanie Guichard said in a press release announcing the results.