Before devolving into personal attacks, the clash between President Donald Trump and Elon Musk began with a disagreement over the country's ballooning debt.

Musk publicly condemned what Trump hopes will be his signature legislative achievement -- a massive tax and immigration bill dubbed the One Big Beautiful Bill Act -- as an "abomination" over its estimated impact on the deficit and debt.

Similar concern among a handful of Republican budget hawks in the Senate is complicating the bill's path to passage by Trump's desired Fourth of July deadline.

Fuel was added to the fire when the nonpartisan Congressional Budget Office released its new score estimating the legislation would add $3 trillion to the national debt over the next decade.

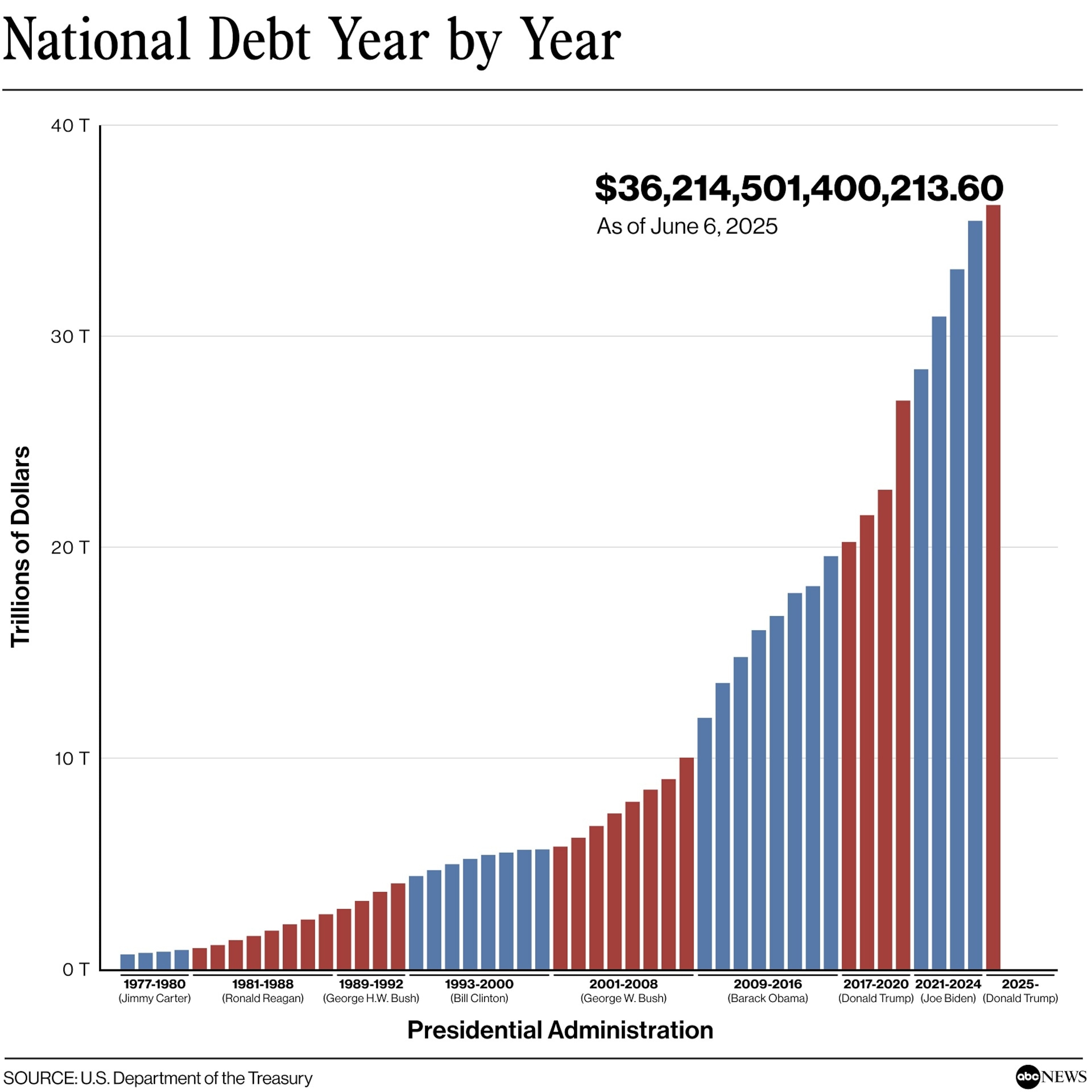

The debt -- the total of annual deficits and interest -- stands at a historic high of $36 trillion. Publicly held debt measures at about 100% the size of the economy.

"We're at World War II levels right now of government debt, and as far as the eye can see going forward we're just climbing," Kent Smetters, a professor at the University of Pennsylvania's Wharton School of Business who formerly worked at the CBO, told ABC News.

The nonpartisan budget office estimated the Trump megabill as passed by the House would add $2.4 trillion to the federal deficit over the next decade, plus bring $550 billion in interest costs.

Republican Sen. Ron Johnson, after the CBO release, told ABC News Live: "I refuse to accept $2 trillion-plus deficits as far as the eye can see as the new normal."

"I'm worried about our kids and grandkids, the fact that we're mortgaging their future. It is wrong. It's immoral," Johnson said.

The White House and House leadership claim the CBO estimate is incorrect. Officials have accused the agency of political bias and take issue with the way it calculates the score without factoring in potential economic growth, which it will in a separate analysis later this year.

Experts say the criticism is not valid. They note that the CBO is currently helmed by an official who served in the George W. Bush administration and that its estimates for this bill are not far off from independent models from banks or other outside institutions.

"I think they know on some level that what they're doing is not fiscally responsible, and so they're trying to blame the messenger for that message," said Stan Veuger, a senior fellow in economic policy studies at the American Enterprise Institute, a right-leaning think tank.

Veuger and Brendan Duke, the senior director for federal budget policy at the left-leaning Center on Budget and Policy Priorities, also emphasize the CBO score is based on the bill as written -- when the expectation is that certain spending and tax provisions Republicans say will expire in a few years will likely be extended, bringing the bill's fiscal cost higher.

Meanwhile, the CBO estimates that the megabill could cut taxes by $3.7 trillion and cut spending by $1.2 trillion.

And Trump has touted another analysis out this week from budget office that said his tariff policy (which the president's suggested could pay for some of his megabill priorities) that says revenue from tariffs would reduce the deficit by $2.8 trillion. Though that estimate assumes the tariffs would be in place permanently, while Trump's shifted on his policy multiple times and his some of his tariff actions are being challenged in court.

The national debt has shot upwards in recent decades under both Democratic and Republican administrations. Large tax cuts under Presidents Ronald Reagan, George W. Bush and Trump led to deficits; as did stimulus packages passed in the wake of the 2008 financial crisis and the 2020 coronavirus pandemic.

To help pay for Trump's megabill, Republicans are making changes to Medicaid and the Supplemental Nutrition Assistance Program. The nonpartisan budget office estimates millions of Americans will lose health insurance due to the cuts.

"It's one thing if we were asking Americans to kind of give a little to reduce the deficit. But this doesn't reduce the deficit," said Duke. "This increases the deficit while leaving millions of low and moderate income payments worse off."

Balancing budget sheets completely would require much more drastic changes. All federal spending would need to be reduced 30% and taxes increased by 26% -- or some combination of the two -- immediately and forever, said Penn Wharton's Smetters.

While many economists believe some government debt is a good thing, as it means many view U.S. securities as among the safest assets in the world, too much debt can have negative ramifications.

Experts said potential consequences could be an increase to interest rates and issues with the bond market. It could also lead to less wage growth and economic progress. A worst-case scenario would be defaulting on debt.

"The United States is definitely not too big to fail," Smetters said. "When failure happens, what you see is significant inflation, you see significant pain and you see social upheaval."